what are common stock warrants

Lets get started today. A stock warrant is a contractual agreement between a company the issuer and an investor the holder.

Difference Between Warrants And Convertibles Investing Financial Management Common Stock

This is similar to the conversion feature of a convertible debt.

. Stock warrants are often used in conjunction with convertible bonds. Discover the Power of thinkorswim Today. Stock warrants if converted become the shares of common stock and reduce.

Chesapeakes common stock Class A warrants Class B warrants and Class C warrants are listed on The Nasdaq Stock Market LLC under the symbols CHK CHKEW CHKEZ and CHKEL respectively. Call warrants are most common and are what were generally talking about when we discuss warrants. A stock warrant gives the holder the right to purchase a companys stock at a specific price and at a specific date.

A stock warrant is issued by an employer that gives the holder the right to buy company shares at a certain price before the expiration. Leverage or at least potential leverage is the prime reason an investor would be interested in warrants. Stock Warrants vs.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Both the warrants and the options eventually expire if they are not exercised by a. Warrants each whole warrant entitles the holder thereof to purchase one share of Class A common stock at a price of 1150 per share Operating Companies 1150.

Ad The Leading Online Publisher of National and State-specific LLC Legal Documents. It gives the investor the right to buy a certain number of shares of stock at a set price. Warrants tend to be cheaper than common stocks.

The commons candles had a 15250 return during the 6-month period while the warrants for provided investors. The predetermined price is the strike price. A stock warrant gives an investor the right to purchase a stock at a specific price and date.

THIS COMMON STOCK PURCHASE WARRANT the Warrant certifies that for value received Heartcore Enterprises Inc a Delaware corporation or its registered assigns the Holder is entitled upon the terms and subject to the limitations on exercise and the conditions hereinafter set forth at any time on or after the IPO Date as defined below and on or prior to. A common stock warrant is a security that gives you the right to buy a stock at a specific price. The easiest way to exercise a warrant is through your broker.

But theres a catch. The warrants will have a term of seven years and Occidental expects to list the warrants on The New York Stock Exchange. The chart below is a 6-month comparative chart of the common shares and warrants.

A put warrant gives an investor the right to sell the stock. A stock warrant is a financial contract between a company and investors that gives the investor the option to purchase the companys stock at a specific price and by a specific date. A convertible bond is a type of fixed-income debt security that a company issues to raise capital.

Enter either your email address or username and we will send you a link to reset your password. Just like an option a stock warrant is issued with a strike price and an expiration date. This more rapid growth in the value of the warrant relative to the common stock is called leverage.

DCGO announced today that it will redeem all of its outstanding warrants the Public Warrants to purchase shares of DocGos common stock par value 00001 per share the Common Stock that were issued under the Warrant Agreement dated as of October 14 2020 the. Common Stock Warrant the warrant to purchase up to 350000 shares of common stock par value 001 per share of the Borrower issued pursuant to the Warrant Purchase Agreement dated as of December 18 1998. DocGo Inc a leading provider of last-mile mobile health services Nasdaq.

Ad Were all about helping you get more from your money. Vicki Hollub President and Chief Executive Officer of Occidental commented The Board recognizes the importance of its stockholders and is committed to maximizing value for all stockholders. Investors with less capital can potentially buy more shares.

The warrants come with an expiration date. The essence of the answer is that the anticipated gain on the warrant must be greater than the anticipated gain on the common stock. Based on 1 documents.

Although stock warrants and stock options are different they have some similarities. Ad Invest in proven private Tech companies before they IPO. Common Stock Warrant means a warrant or other right to purchase shares of Company Common Stock.

Berkshire also owns 10 billion of Occidental preferred stock and has warrants to buy another 839 million common shares for 5 billion or 5962 each. Our Suite of Platforms isnt Just Made For the Trading Obsessed - its Made by Them. Stock warrants are corporate issued certificates that entitle their holders to buy a specified number of common shares of the issuing corporation at a stated price and within a certain predetermined period.

A stock warrant is issued. Warrants are similar to the options but with one critical difference. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

The strike price is the price at which the warrant becomes exercisable or in the money.

Nventory Agreement Template In 2022 Itinerary Template Templates Agreement

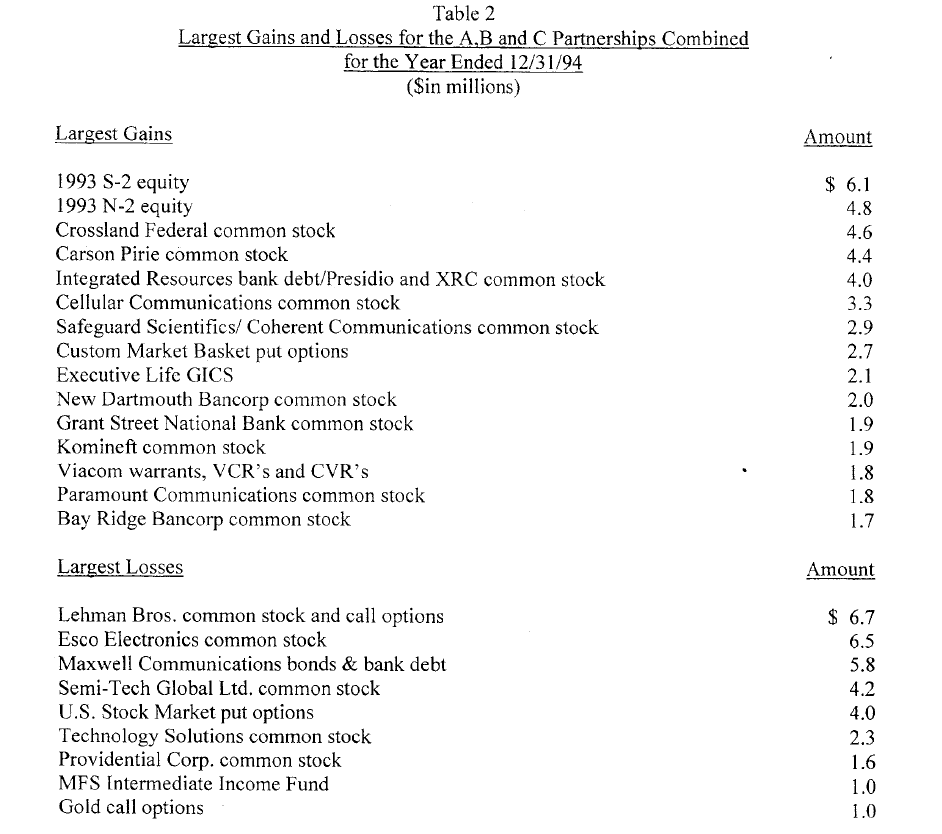

Lessons From Baupost Group S 1994 Letter Lettering Lesson Value Investing

Trading Mechanics Of Securities In Secondary Market Business Articles Secondary Market Marketing

Graduated Lease In 2022 Financial Management Being A Landlord Lease

Common Stock Warrants Exclusive Database Common Stock Stock Common

Arrearages Meaning Example Uses And More In 2022 Accounting And Finance Financial Management Meant To Be

Triangle Shaped Crystal Tombstone Triangle Shape Crystals Preferred Stock

Convertible Bonds Vs Warrants Meaning Differences Bbalectures Convertible Bond Business Articles Bond

Solid Power To Trade On Nasdaq As Sldp After Completing Nasdaq Power Trading

![]()

Common Stock Warrants Infographic Common Stock Science Infographics

Common Stock Valuation Security Analysis Two Basic Approaches Common Stock Business Articles Finance

Corporate Finance 16 Convertible Bonds Warrants

Subordinated Debt Ironwood Capital Avon Ct

Month To Month Lease Meaning Pros Cons And More In 2022 Financial Management Lease Finance

Dilutive Securities Accounting And Finance Financial Instrument Financial Management

What Is Cagr And How It S Useful Finance Investing Financial Management Business Basics

Common Stock Warrants Infographic Common Stock Science Infographics